Walmart Inc. (WMT) Stock Performance: A Comprehensive Analysis

Table of Contents

- Walmart: Our Take On An Attractive Entry Point (NYSE:WMT) | Seeking Alpha

- Walmart rewrites the rulebook: Equity, expansion, and evolution ...

- The top Walmart analyst says the company has one big advantage over ...

- Walmart stock hits new all-time high; Is 0 next for WMT?

- Walmart Just Crushed Earnings - WMT Stock - YouTube

- "WMT Stock Ticker (Walmart)" Sticker for Sale by the-two-store | Redbubble

- Walmart Shares Zoom to All-Time High

- omurtlak91: walmart stock prices

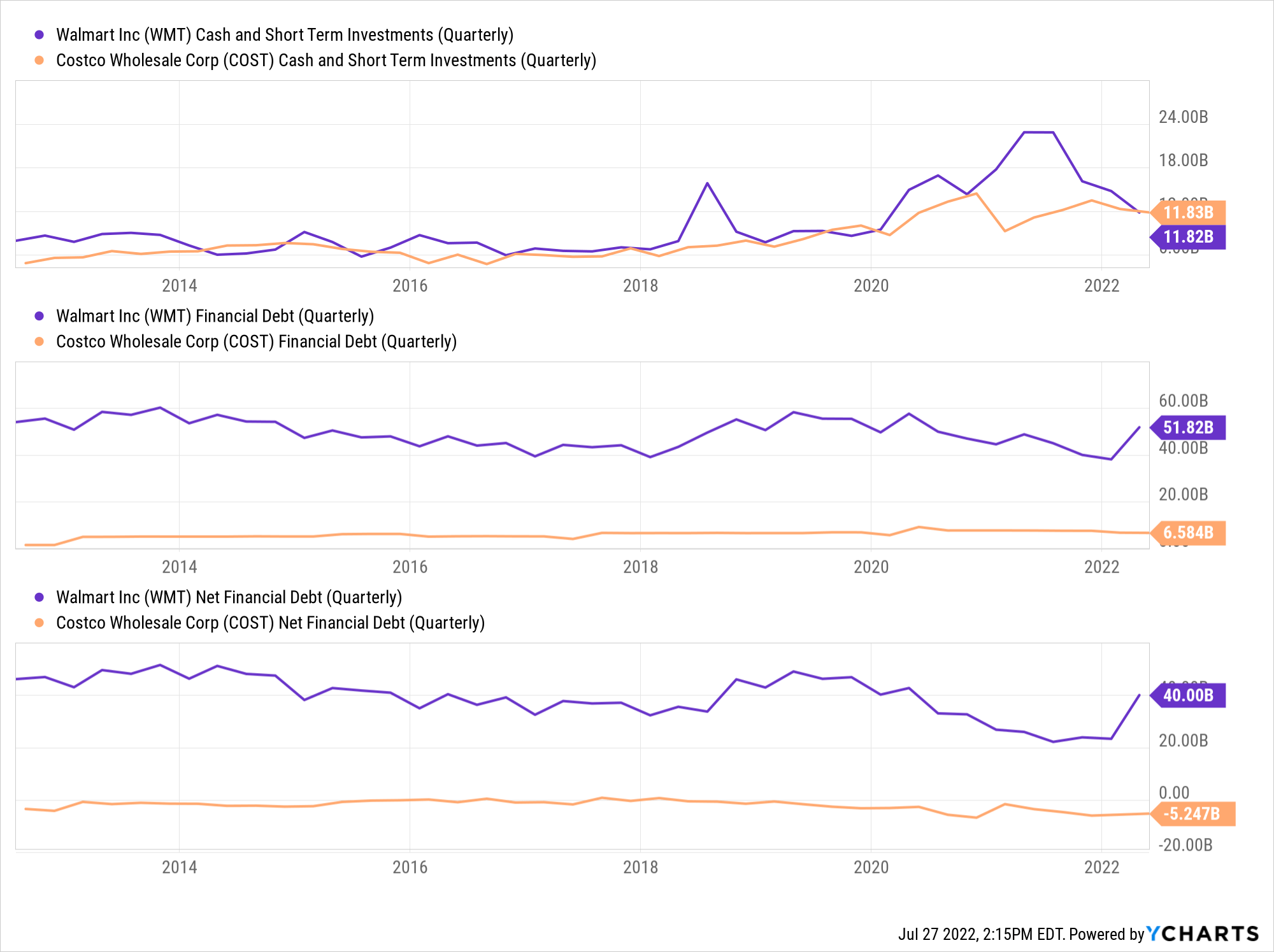

- Walmart Vs. Costco Stock: Which Is The Better Buy? | Seeking Alpha

- Walmart Stock Could Hit New 2020 Low

Current Stock Price

:max_bytes(150000):strip_icc()/wmt1-f71b1339ecb14db4ac4897615c8b1169.jpg)

Stock Performance

:max_bytes(150000):strip_icc()/wmt2-556fc3cbc6e744d9a48bfab137f0dd8c.jpg)

The company's quarterly earnings report showed a significant increase in revenue, driven by a 40% growth in e-commerce sales. This growth is a testament to Walmart's efforts to expand its online presence and improve its digital capabilities. The company's investment in e-commerce has enabled it to compete effectively with online retailers such as Amazon.

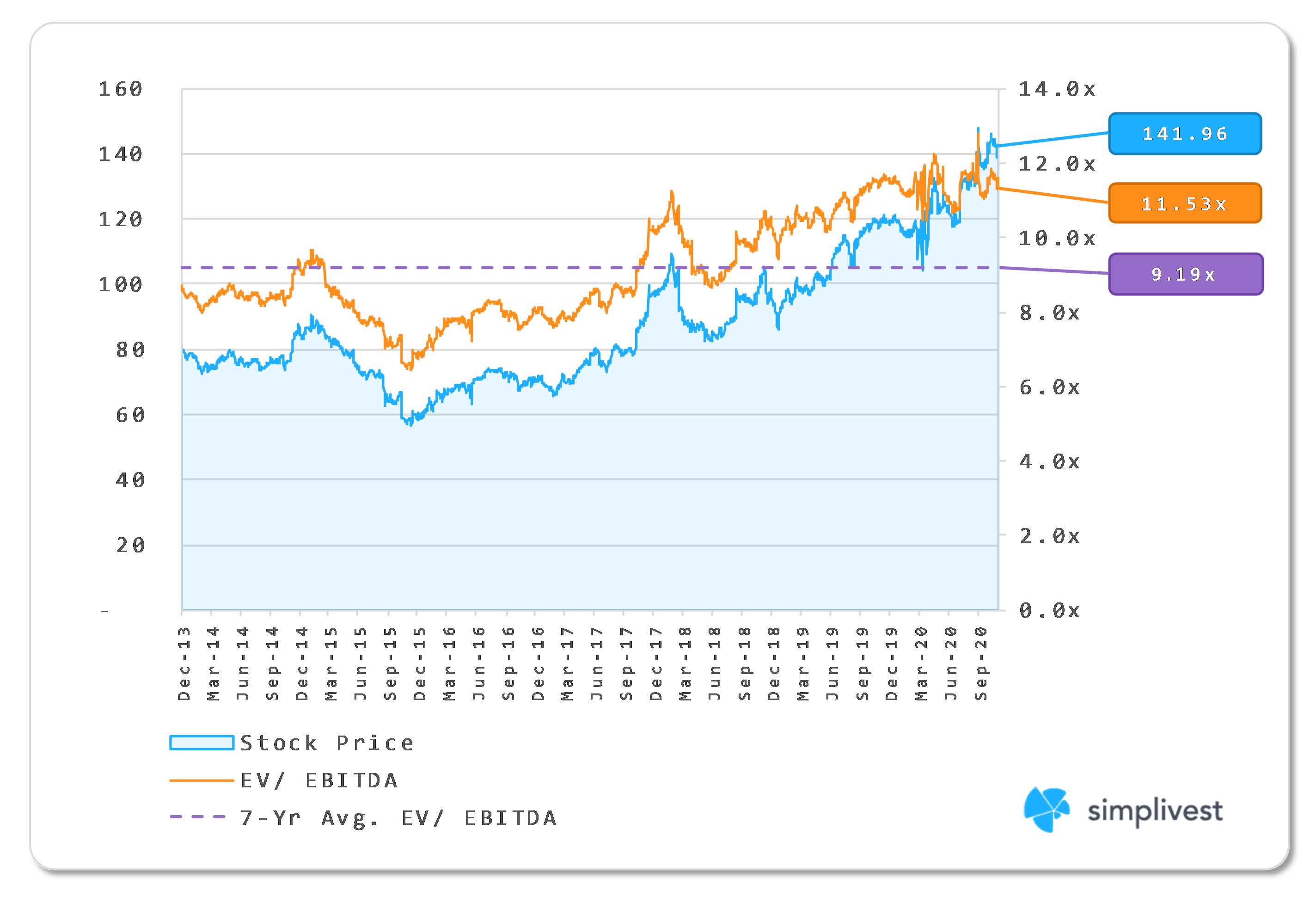

Technical Analysis

From a technical perspective, the stock price of Walmart Inc. (WMT) is showing a bullish trend. The stock's moving averages are indicating an upward trend, with the 50-day moving average crossing above the 200-day moving average. This is a positive sign for investors, indicating that the stock is likely to continue its upward trend.In addition, the stock's relative strength index (RSI) is indicating that the stock is not overbought, with a reading of 60. This suggests that there is still room for the stock to grow, and investors can consider buying the stock at current levels.

Fundamental Analysis

From a fundamental perspective, Walmart Inc. (WMT) has a strong financial position. The company has a solid balance sheet, with a debt-to-equity ratio of 0.5. The company's return on equity (ROE) is also impressive, with a reading of 20.5%. This indicates that the company is generating strong profits from its operations.The company's dividend yield is also attractive, with a yield of 1.8%. This makes the stock an attractive option for income investors, who are looking for regular income from their investments.

In conclusion, the stock price of Walmart Inc. (WMT) is showing a strong upward trend, driven by the company's strong financial performance and strategic investments in digital transformation. With a solid balance sheet, attractive dividend yield, and bullish technical indicators, the stock is an attractive option for investors. As of today, the stock price of Walmart Inc. (WMT) is $143.12, according to the WSJ. Investors can consider buying the stock at current levels, with a potential target price of $160.However, it's essential to note that the stock market can be volatile, and investors should do their own research before making any investment decisions. It's also crucial to consider the company's future growth prospects, competitive landscape, and potential risks before investing in the stock.

Note: This article is for informational purposes only and should not be considered as investment advice. The stock price and technical analysis are subject to change and may not reflect the current market situation.