W2 Release Dates for 2024 and 2025: What You Need to Know

Table of Contents

- ADP W-2 data hacked in latest breach

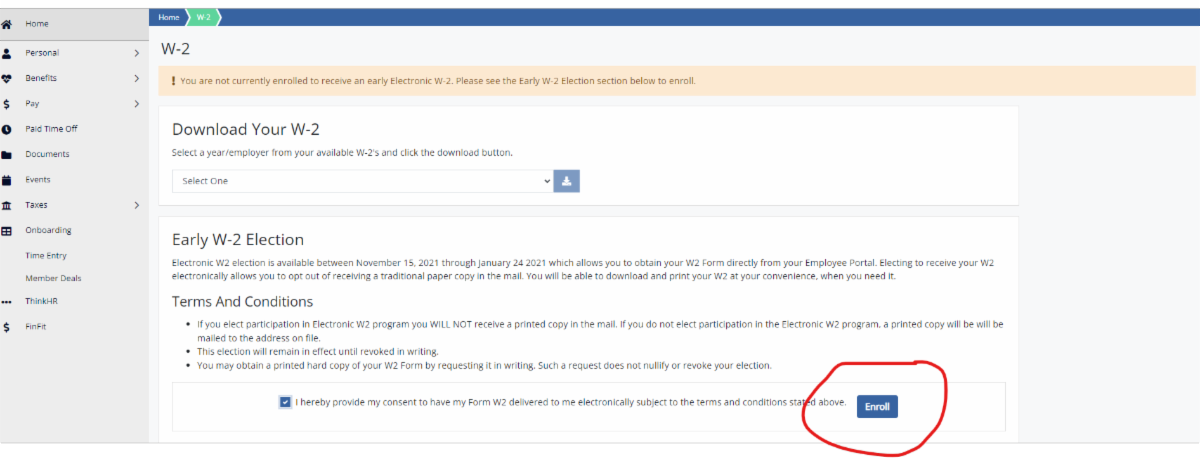

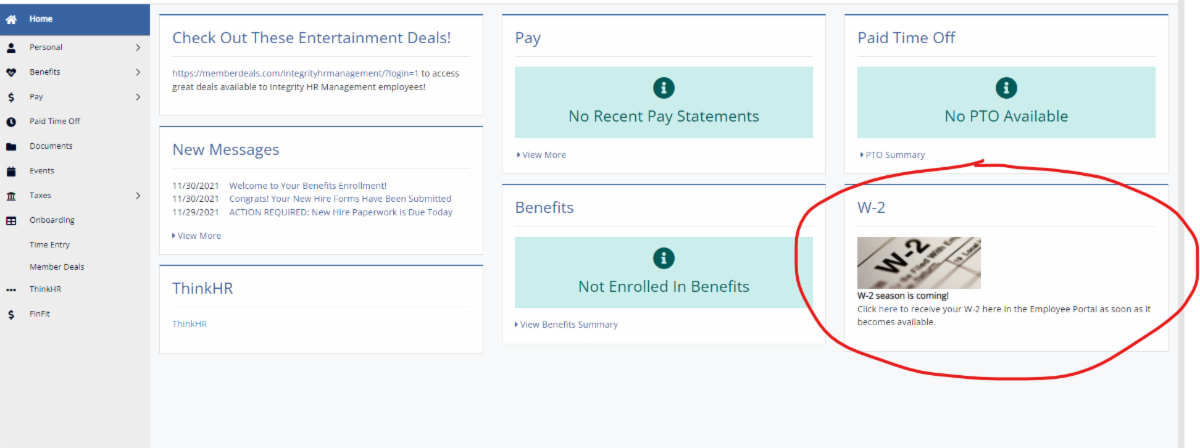

- Elect to get your W2 electronically for 2024!

- W2 W2c Form - Fill Out and Sign Printable PDF Template | airSlate SignNow

- Tax Season 2024: Here's What to Do If You Haven't Received Your W-2 Yet ...

- Returning to Call of Duty WW2 in 2024! | 7 YEARS LATER - YouTube

- DOD's 2024 Audit Shows Progress Toward 2028 Goals > Air Force Life ...

- Free W2 Template Of Blank Dd form 214 Pdf forms 4626 ...

- Dd Form 2026 - Fill Online, Printable, Fillable, Blank | pdfFiller

- Free Printable W2c Form 2021 - Printable Form 2024

- Elect to get your W2 electronically for 2024!

When Do W2s Come Out in 2024?

When Do W2s Come Out in 2025?

National Tax Reporting Process

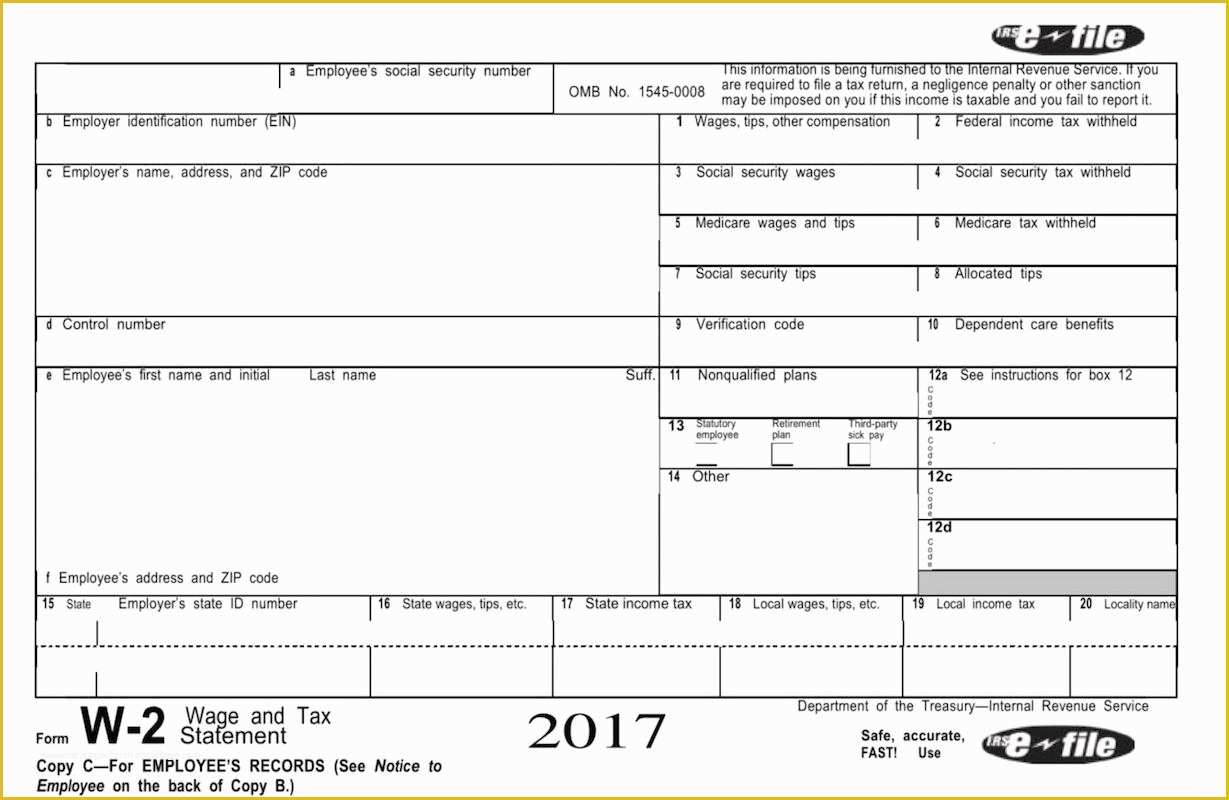

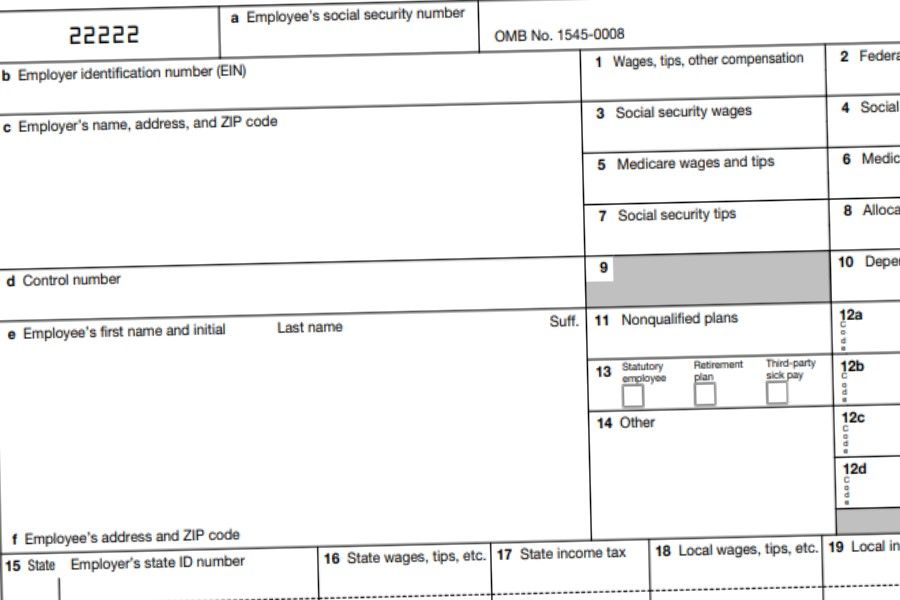

The national tax reporting process involves several key steps: Employer Reporting: Employers are required to report employee income and taxes withheld to the IRS using Form W2. Employee Receipt: Employees receive their W2 forms, which provide a detailed breakdown of their income and taxes withheld. Tax Filing: Employees use their W2 forms to file their tax returns, either electronically or by mail. IRS Processing: The IRS processes tax returns, reviews W2 forms, and issues refunds or notifies taxpayers of any discrepancies.

What to Do If You Don't Receive Your W2

If you don't receive your W2 form by the expected date, there are several steps you can take: Contact Your Employer: Reach out to your employer's HR or payroll department to inquire about the status of your W2 form. File Form 4852: If you're unable to obtain a W2 form, you can file Form 4852, which is a substitute for the W2 form. Contact the IRS: If you're still having issues, you can contact the IRS directly for assistance. In conclusion, W2 forms for the 2024 and 2025 tax years are expected to be distributed by January 31st of each year. It's essential to stay in touch with your employer and understand the national tax reporting process to ensure a smooth tax filing experience. If you have any questions or concerns, don't hesitate to reach out to your employer or the IRS for assistance.By following these guidelines and staying informed, you'll be well-prepared to receive your W2 form and file your tax return on time.

Key Takeaways:- W2 forms for 2024 are expected to be distributed by January 31, 2024.

- W2 forms for 2025 are expected to be distributed by January 31, 2025.

- The national tax reporting process involves employer reporting, employee receipt, tax filing, and IRS processing.

- If you don't receive your W2 form, contact your employer, file Form 4852, or contact the IRS for assistance.