US Inflation Sees a Slight Dip, But Trade War Looms as a Potential Threat

Table of Contents

- Headline Consumer Price Index inflation - Dallasfed.org

- The latest US CPI report: Under the surface - Moneyweb

- Cpi Data Usa - Ignacio King Berita

- CPI là gì? Ý nghĩa và công thức tính chỉ số giá tiêu dùng CPI

- Figure-2 . The Growth of Consumer Price Index (CPI) in the periode 1999 ...

- Consumer Price Index or CPI is a measure of the average change over ...

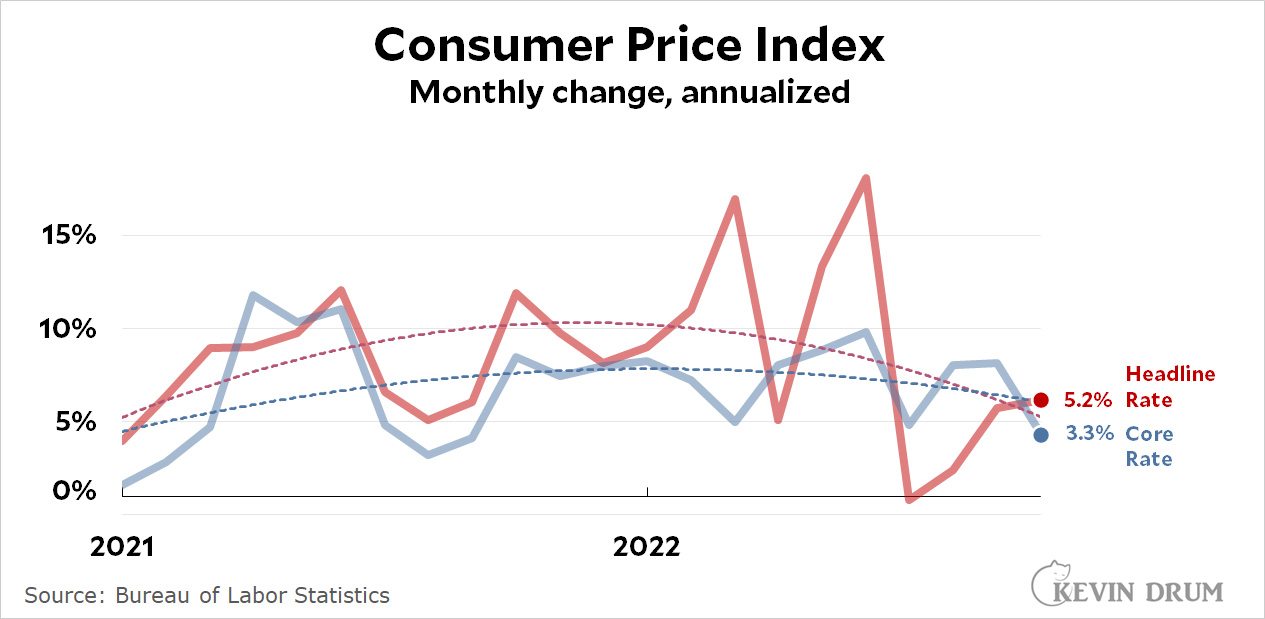

- Core CPI, the number to care about, plummeted this month – Kevin Drum

- The CPI Broken Record Continues, Rent Keeps Rising, Otherwise Inflation ...

- 미국 8월 소비자물가지수(CPI) 8.3%…전망치 상회하자 시장 ‘흔들’ - 토큰포스트

- US CPI at 5%, Core CPI at 5.6%; Macro; Rating Changes; New Issues ...

The Consumer Price Index (CPI), which measures the average change in prices of a basket of goods and services, rose by 2.3% in August compared to the same period last year. This is a slight decrease from the 2.5% increase recorded in July. The core CPI, which excludes volatile food and energy prices, also saw a marginal decline, increasing by 2.0% compared to 2.2% in the previous month. These numbers indicate that inflation is still within the Federal Reserve's target range of 2%, but the trade war with China could potentially push prices up in the coming months.

Impact of Trade War on Inflation

The trade war has also led to a decline in business confidence, with many companies delaying investments and hiring due to uncertainty about the future. This could lead to a slowdown in economic growth, which in turn could impact inflation. The Federal Reserve has already cut interest rates twice this year to boost economic growth, but the trade war poses a significant risk to the economy, and the Fed may need to take further action to mitigate its impact.

What's Next for the US Economy?

In conclusion, while the US inflation has cooled down last month, the trade war with China poses a significant threat to the economy. The impact of the trade war on inflation and economic growth will be closely watched in the coming months, and the Federal Reserve will need to take a cautious approach to monetary policy to mitigate its effects. As the trade war continues to evolve, it's essential for consumers, investors, and businesses to stay informed about the latest developments and their potential impact on the economy.