US Inflation Rate Slows Down: April 2025 CPI Report Reveals 2.8% Increase

Table of Contents

- CPI Adalah: Pengertian, Manfaat, dan Cara Hitungnya - TPFx

- The latest US CPI report: Under the surface - Moneyweb

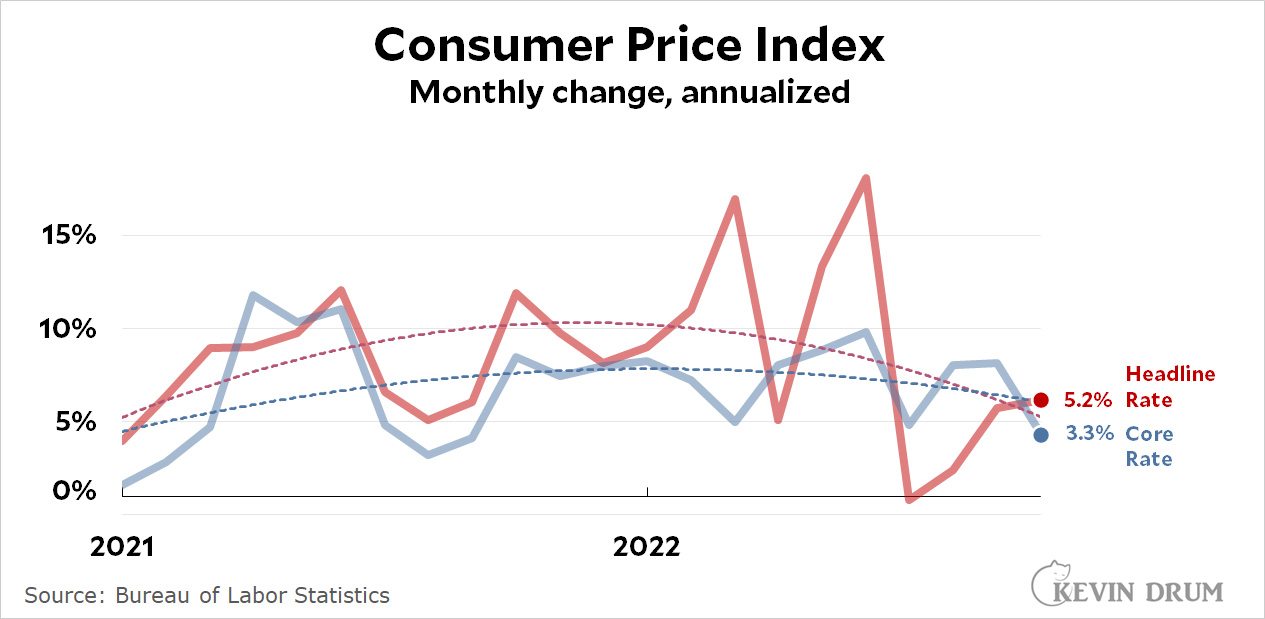

- Core CPI, the number to care about, plummeted this month – Kevin Drum

- Antwort What is current CPI rate? Weitere Antworten – What is the ...

- Consumer Price Index: Tujuan, Jenis, Contoh dan Cara Mengukurnya

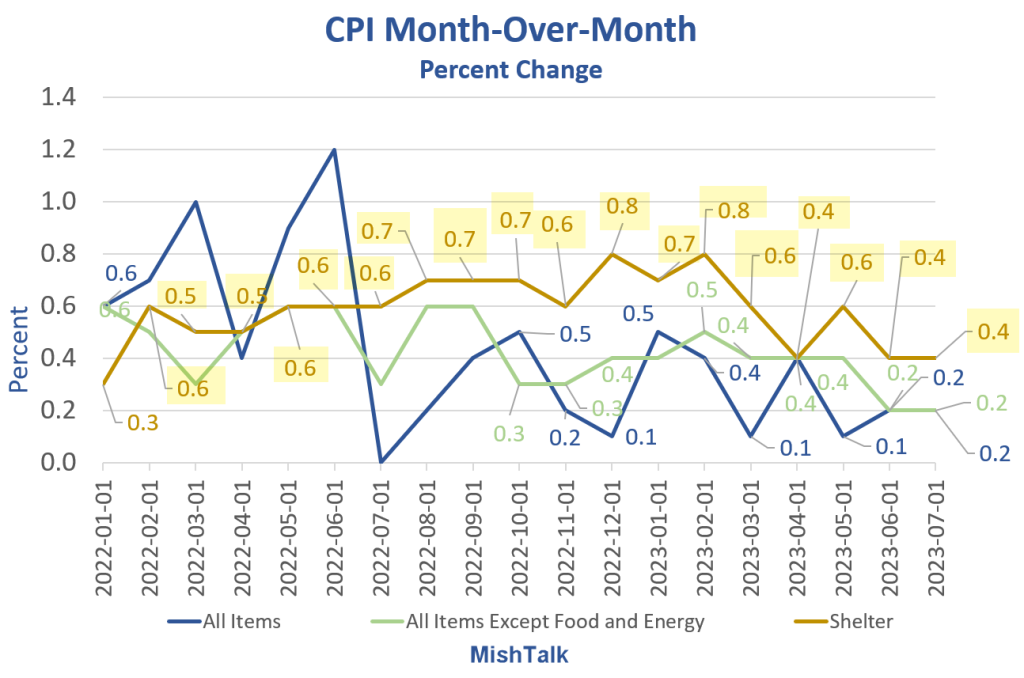

- CPI Rises 0.2 Percent, Shelter Again Accounts for Most of the Increase ...

- Chart: Surging Gas Prices Drive August Uptick in Inflation | Statista

- 物聯網應用實例 - BTCC 熱門知識

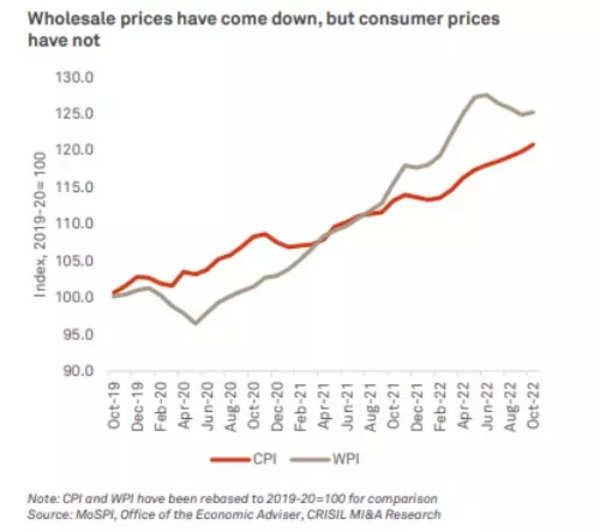

- CPI inflation is showing signs of moderating, but it's too early to ...

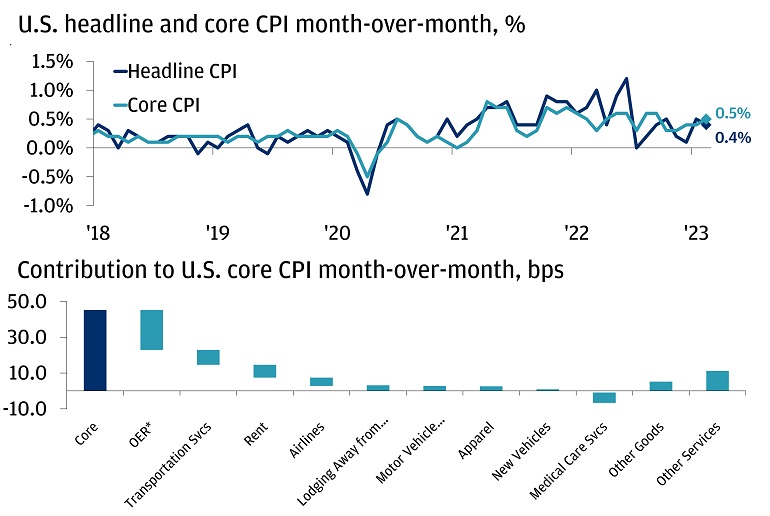

- Quick shot: The February CPI print: In-line, but still too hot

The CPI report is a key indicator of inflation, measuring the average change in prices of a basket of goods and services consumed by households. The report takes into account various categories, including food, housing, apparel, transportation, and healthcare, among others. The April 2025 report shows that the inflation rate has decreased from the previous month, indicating a decline in the pace of price increases.

Key Highlights of the April 2025 CPI Report

- The inflation rate eased to 2.8% in April 2025, down from 3.1% in the previous month.

- The core inflation rate, which excludes food and energy prices, remained steady at 2.5%.

- The food index increased by 0.2%, while the energy index decreased by 1.1%.

- The housing index rose by 0.3%, driven by higher rents and owners' equivalent rent.

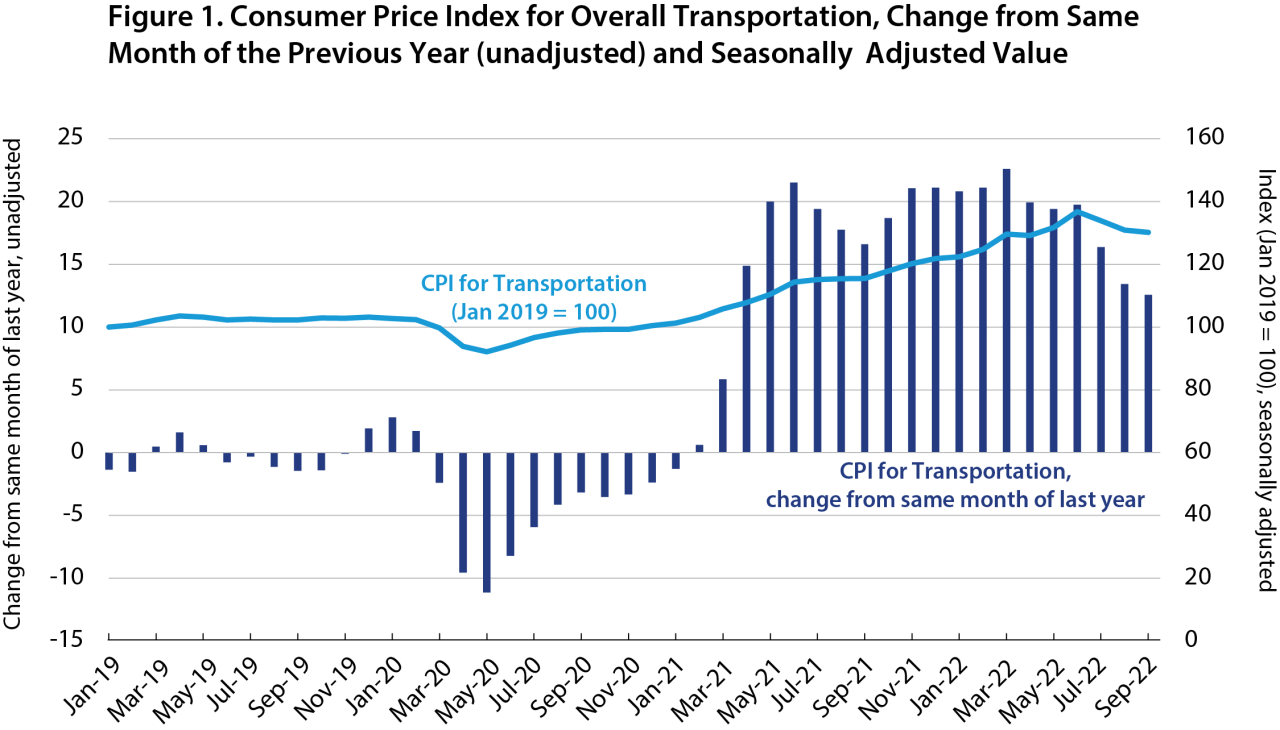

- The apparel index increased by 0.5%, while the transportation index decreased by 0.2%.

Impact on the Economy and Consumers

The slowdown in inflation rate is expected to have a positive impact on the economy and consumers. With lower inflation, consumers will have more purchasing power, as their money will go further. This, in turn, can boost consumer spending, which is a key driver of economic growth. Additionally, lower inflation can also lead to lower interest rates, making borrowing cheaper and increasing demand for credit.

However, it's worth noting that the inflation rate is still above the Federal Reserve's target rate of 2%. This means that the central bank may still need to keep a close eye on inflation and adjust monetary policy accordingly to ensure that the economy remains on a stable growth path.

The April 2025 CPI report suggests that the US economy is moving in the right direction, with inflationary pressures easing. While the inflation rate is still above the target rate, the slowdown is a welcome sign for consumers and businesses. As the economy continues to grow and evolve, it's essential to keep a close eye on inflation and other economic indicators to ensure that the growth is sustainable and benefits all sectors of the economy.

For more information on the CPI report and its implications, visit CNBC for the latest news and analysis.

Note: The article is based on hypothetical data and is for illustration purposes only. The actual CPI report and data may vary.