Upcoming Reforms: Navigating Changes in 2025 and 2026 for Your Qualified Retirement Plan

Table of Contents

- Roth 401 K

- Maxing Out 401(k) & Roth IRA Plans | Limits, Benefits & What Is Next

- Max 401k Employer Contribution 2025 - Lillian Wallace

- How Much Should I Contribute to My 401(k)?

- How Much Should I Contribute to My 401(k)?

- Roth Ira Contribution Limits 2024 Catch Up Over 50 - Enid Jesselyn

- New Roth 401(k) Rule Changes: What You Should Know for 2025 | Kiplinger

- 401K & Roth 401K 2024. Max đến K? Có nên rollover IRA & Roth IRA ...

- HSA Archives - Self-Direct your IRA

- Roth 401(k) Contribution Limits for 2021 | Kiplinger

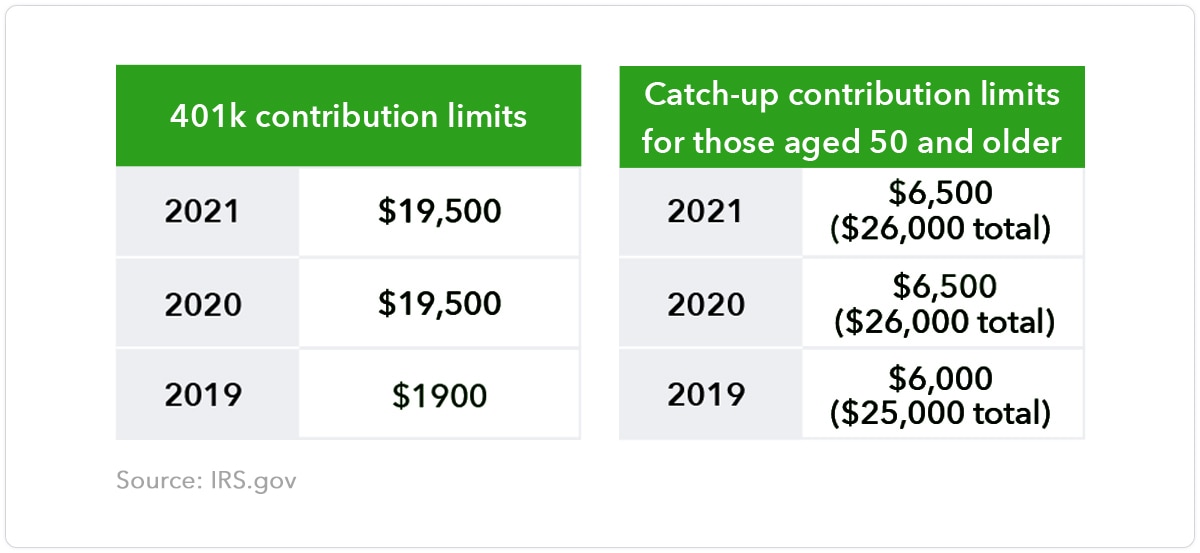

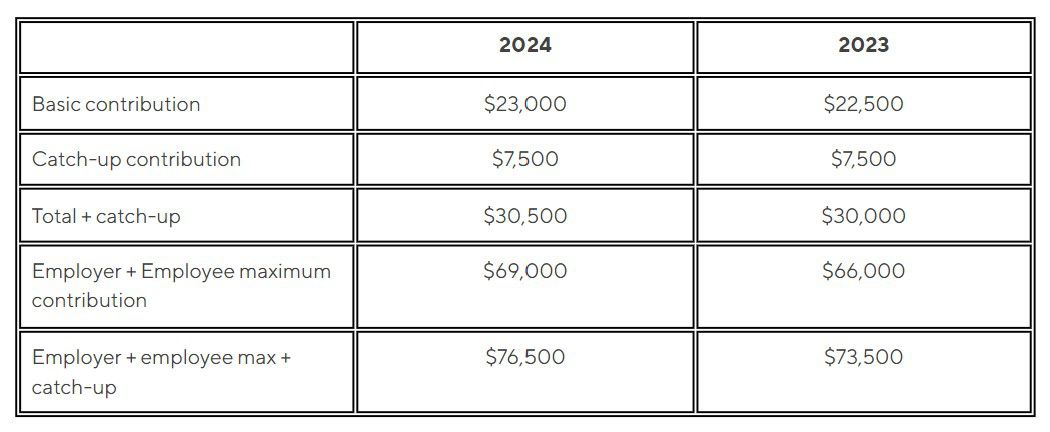

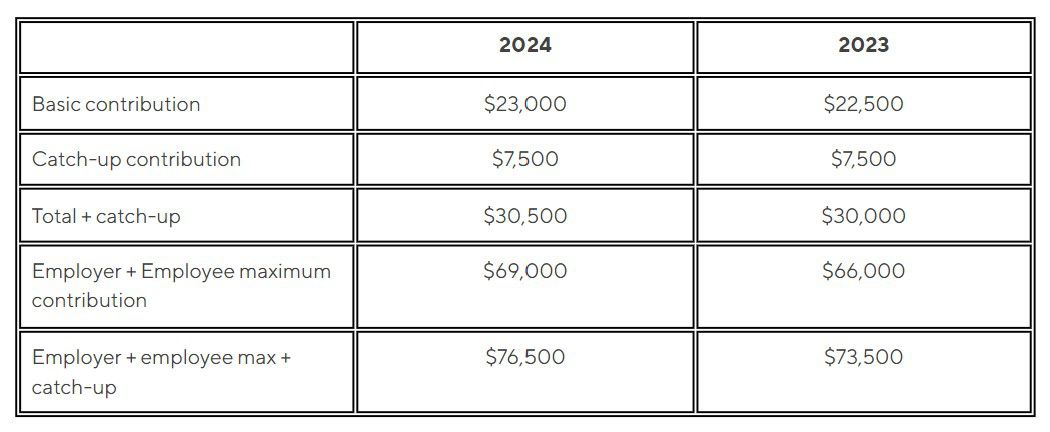

Increased Contribution Limits

_and_Roth_IRA_Plans.png?width=3840&name=Things_to_Consider_Before_Maxing_Out_401(k)_and_Roth_IRA_Plans.png)

Expansion of Automatic Enrollment

Student Loan Repayment Benefits

In 2026, qualified retirement plans will be allowed to offer student loan repayment benefits as an eligible benefit. This means that employers can make matching contributions to an employee's retirement account based on the employee's student loan payments. This innovative approach aims to help employees tackle their student debt while also building their retirement savings. Plan sponsors should consider adding this benefit to their plan to attract and retain top talent in a competitive job market.

Roth 401(k) and Roth IRA Changes

The upcoming years will also bring changes to Roth 401(k) and Roth IRA accounts. Starting from 2025, the income limits for contributing to a Roth IRA will increase, allowing more individuals to take advantage of this tax-advantaged savings vehicle. Additionally, the Roth 401(k) catch-up contribution limit will be indexed for inflation, providing older workers with more opportunities to save for retirement.

Plan Sponsor Action Items

To prepare for these changes, plan sponsors should take the following steps: Review plan documents and amend them as necessary to reflect the increased contribution limits and other reforms. Communicate the changes to plan participants, highlighting the benefits and implications of the new rules. Consider adding student loan repayment benefits to their plan to enhance employee benefits and attract top talent. Monitor regulatory updates and seek professional advice to ensure compliance with the new rules. In conclusion, the changes coming in 2025 and 2026 for qualified retirement plans are significant and far-reaching. By understanding these reforms and taking proactive steps, plan sponsors can help their participants build a more secure financial future. As the retirement landscape continues to evolve, it is essential to stay informed and adapt to the changing regulatory environment. By doing so, you can ensure that your qualified retirement plan remains a valuable benefit for your employees and a key component of your overall benefits strategy.Stay ahead of the curve and get ready to navigate the upcoming changes in the world of qualified retirement plans. Contact us to learn more about how these reforms will impact your plan and what you can do to prepare.