Understanding Actuarial Life Tables: A Key Component of Social Security Administration

Table of Contents

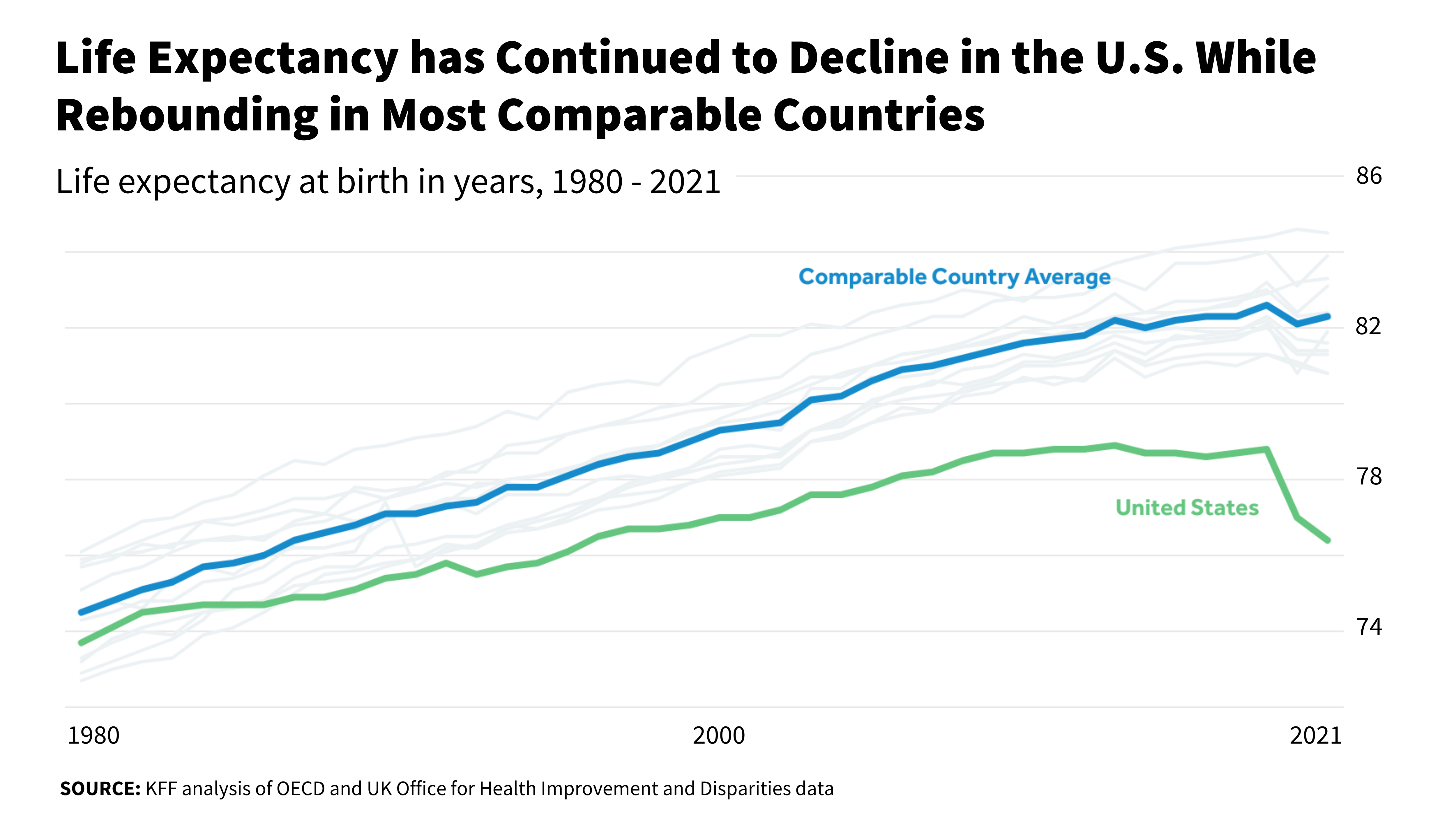

- The CDC Just Released 2021 Data: U.S. Life Expectancy Drops Due to ...

- U.S. life expectancy fell by a year in the first half of 2020, CDC ...

- Life expectancy in US reached 25-year low, the result of Covid and drug ...

- New Life Expectancy Tables Effective In 2024 - Kris Shalne

- World Life Expectancy 2024 Us - Lisa Leeanne

- Us Life Expectancy 2024 Cdc - Kiah Arlinda

- Life Expectancy Tables 2024 By Country - Avie Margit

- CDC Data Show U.S. Life Expectancy Continues to Decline | AAFP

- Life expectancy estimates and changes (in years) from 2019 for the ...

- World Life Expectancy 2024 Us - Lisa Leeanne

What are Actuarial Life Tables?

Construction of Actuarial Life Tables

Application of Actuarial Life Tables in the SSA

The SSA uses actuarial life tables in several ways: 1. Benefit calculations: Actuarial life tables are used to estimate the life expectancy of beneficiaries, which informs benefit calculations, such as the calculation of retirement benefits and survivor benefits. 2. Trust fund projections: The tables are used to project the future financial condition of the Social Security trust funds, which helps policymakers make informed decisions about the program's sustainability. 3. Policy analysis: Actuarial life tables are used to analyze the impact of policy changes on the Social Security program, such as changes to the retirement age or benefit formulas. In conclusion, actuarial life tables are a critical component of the SSA's efforts to ensure the long-term sustainability of the Social Security program. By understanding mortality trends and estimating life expectancy, the SSA can make informed decisions about benefit calculations, trust fund projections, and policy analysis. As the population continues to age and mortality rates evolve, the importance of actuarial life tables will only continue to grow. By staying up-to-date with the latest developments in actuarial science and demography, the SSA can ensure that the Social Security program remains a vital source of support for generations to come.Keyword: Actuarial Life Table, United States Social Security Administration, Life Expectancy, Mortality Rates, Benefit Calculations, Trust Fund Projections, Policy Analysis