Bank of America Corporation: A Comprehensive Review of Stock Price and Latest News

Table of Contents

- BAC Stock - Bank of America Isn't for Long-Term Investors | InvestorPlace

- This Bank of America Corp (BAC) Stock Dip Is a Buy

- BAC Stock - Bank of America Stock Price Quote - NYSE | Morningstar

- BAC Stock - YouTube

- How to Trade Bank of America Corp (BAC) Stock Now | InvestorPlace

- Steep Decline In BAC Stock Price, Still Facing Sellers Dominance?

- Bank of America Corp (BAC) Stock Is a Whale of an Opportunity ...

- Make Bank of America Corp (BAC) Stock a Great Trade Again | InvestorPlace

- Buy Bank of America Corp (BAC) Stock as Banks Make Their Move

- Bank of America Stock: Love The Crash (NYSE:BAC) | Seeking Alpha

Bank of America Corporation, commonly referred to as BAC, is one of the largest banking institutions in the United States. With a rich history dating back to 1904, the company has established itself as a leader in the financial services industry. In this article, we will delve into the current stock price and latest news surrounding BAC, providing investors with a comprehensive overview of the company's performance.

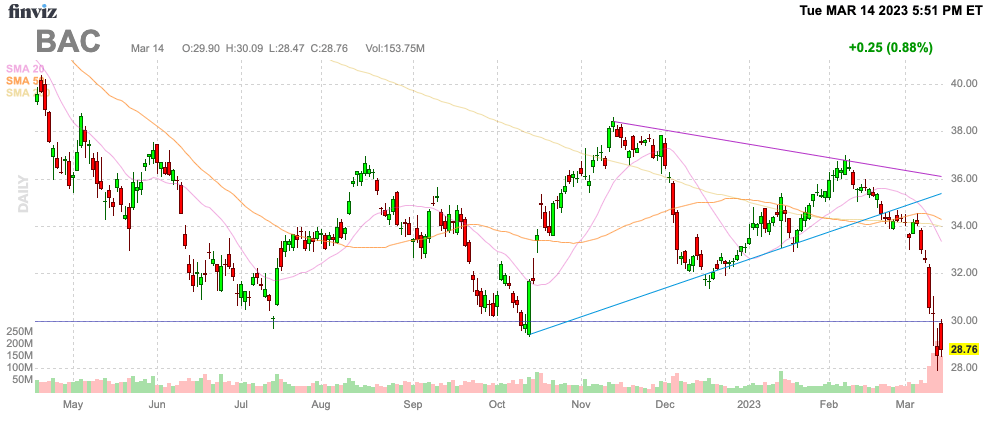

Current Stock Price

As of the latest update, the stock price of Bank of America Corporation (BAC) is $43.21 per share. The company's market capitalization stands at over $350 billion, making it one of the largest publicly traded companies in the world. BAC's stock price has experienced fluctuations in recent years, influenced by various market and economic factors. However, the company's strong financial foundation and diversified business model have enabled it to maintain a stable position in the market.

Latest News

According to recent news reports from Reuters, Bank of America Corporation has been actively expanding its digital banking services. The company has invested heavily in technology, aiming to enhance customer experience and improve operational efficiency. This strategic move is expected to drive growth and increase competitiveness in the banking sector.

In addition, BAC has been focusing on sustainability and environmental, social, and governance (ESG) initiatives. The company has set ambitious targets to reduce its carbon footprint and promote diversity and inclusion in the workplace. These efforts have been recognized by investors and stakeholders, contributing to the company's positive reputation and long-term growth prospects.

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/06b2be46-9454-4b31-8c0e-7e13c47e080c.jpg)

Financial Performance

Bank of America Corporation's financial performance has been impressive in recent years. The company reported a net income of $27.4 billion in 2022, with revenue reaching $102.1 billion. BAC's return on equity (ROE) stands at 10.5%, indicating a strong ability to generate profits from shareholders' equity. The company's financial stability and resilience have enabled it to navigate challenging market conditions and maintain a competitive edge.

Investment Opportunities

For investors looking to diversify their portfolios, Bank of America Corporation (BAC) presents a compelling opportunity. The company's strong financials, diversified business model, and commitment to sustainability make it an attractive investment option. With a dividend yield of 2.2%, BAC offers a relatively stable source of income for investors seeking regular returns.

In conclusion, Bank of America Corporation's current stock price and latest news indicate a positive outlook for the company. With its strong financial foundation, diversified business model, and commitment to sustainability, BAC is well-positioned for long-term growth and success. Investors looking to capitalize on the company's potential can consider adding BAC to their portfolios, while keeping a close eye on market trends and news updates from reputable sources like Reuters.

Stay up-to-date with the latest news and stock price information on Bank of America Corporation (BAC) by visiting Reuters or other reputable financial news sources.

Note: The stock price and financial data mentioned in this article are subject to change and may not reflect the current market situation. It is essential to conduct thorough research and consult with financial experts before making any investment decisions.