As we step into the new year, it's essential to stay updated on the latest guidelines that impact various aspects of our lives, including healthcare, taxes, and financial assistance programs. The 2025 Federal Poverty Level (FPL) guidelines, recently released by the Department of Health and Human Services (HHS), play a crucial role in determining eligibility for these programs. In this article, we'll delve into the 2025 FPL guidelines, exploring the changes, implications, and how they may affect you.

What are the Federal Poverty Level Guidelines?

The Federal Poverty Level guidelines are a set of income thresholds used to determine eligibility for various government programs, such as Medicaid, the Children's Health Insurance Program (CHIP), and the Affordable Care Act (ACA) marketplace plans. These guidelines are updated annually to reflect changes in the cost of living.

2025 Federal Poverty Level Guidelines: Key Changes

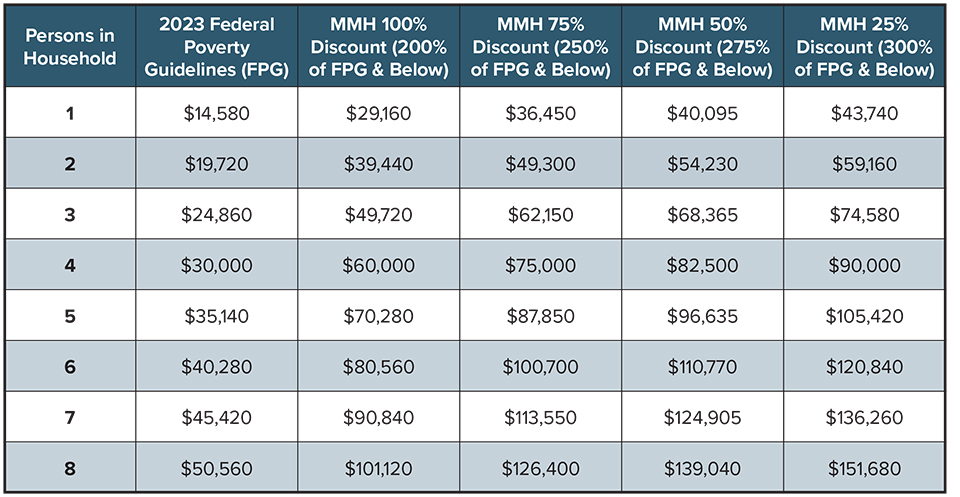

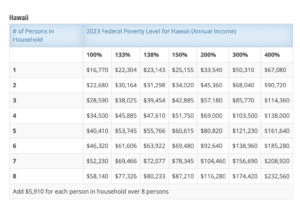

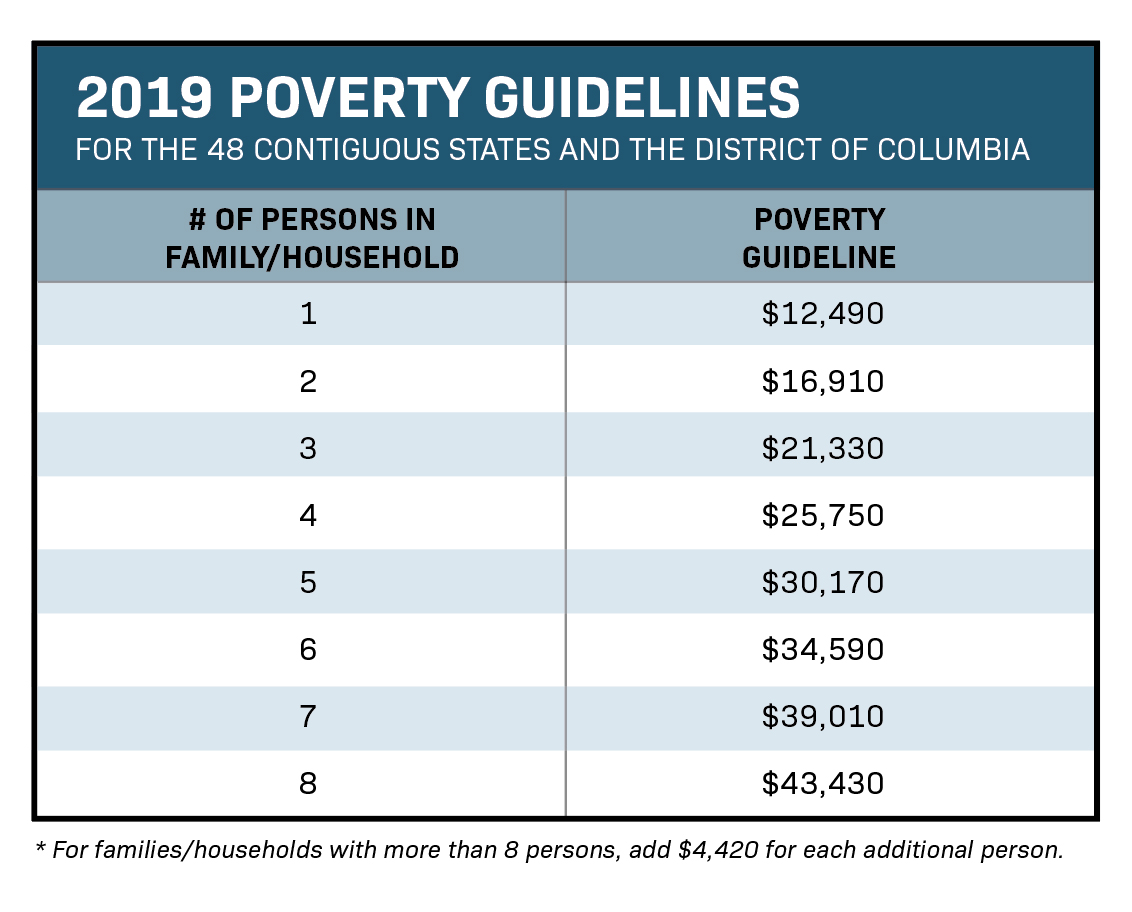

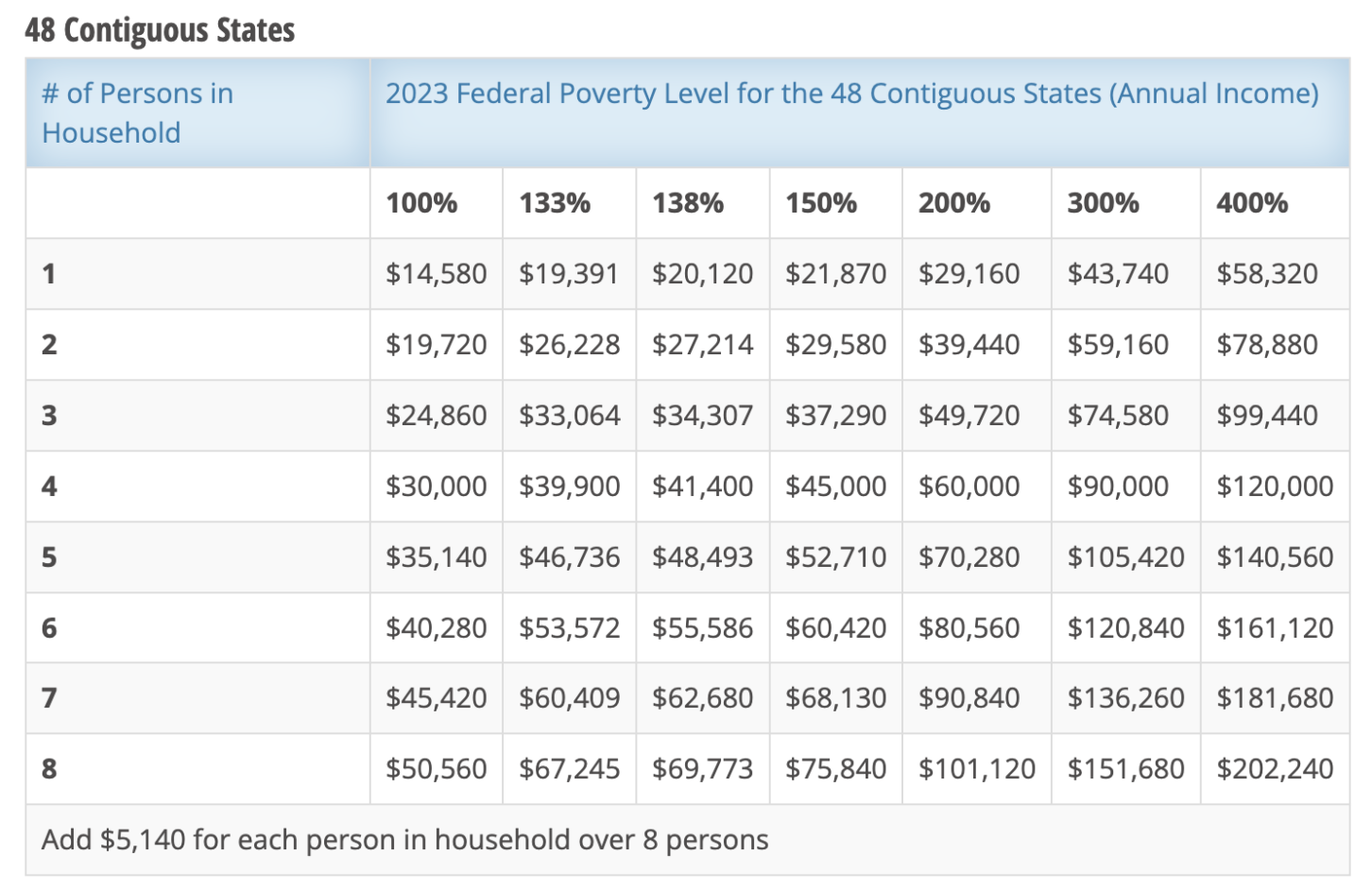

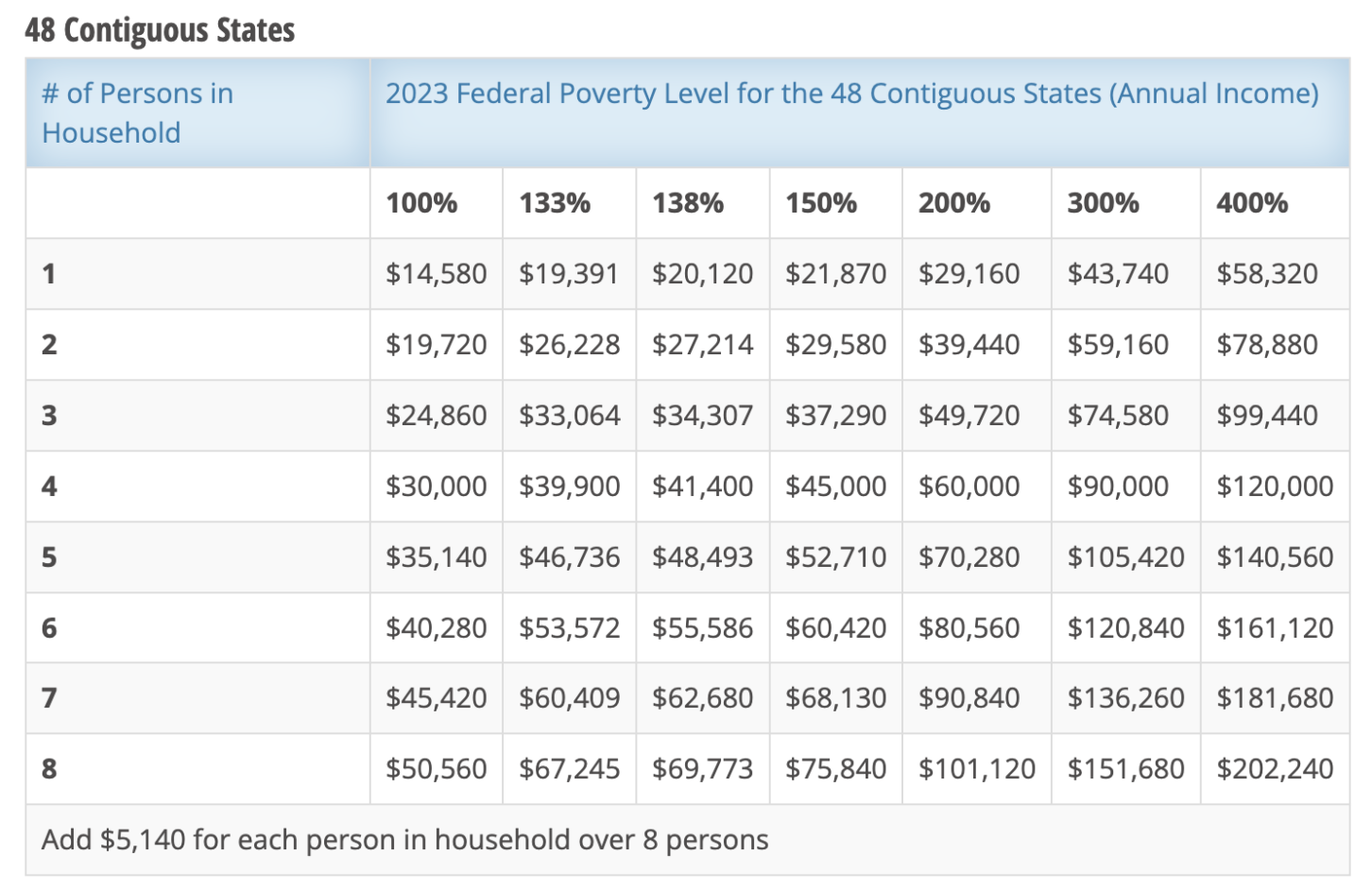

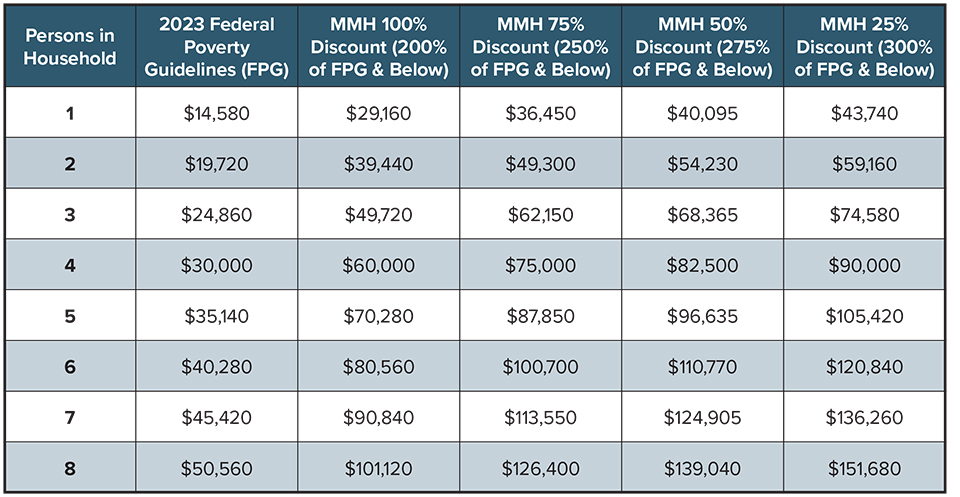

The 2025 FPL guidelines have increased by 3.5% from the previous year, reflecting the rising cost of living. The new guidelines are as follows:

100% of the FPL: $14,580 for an individual, $29,580 for a family of three, and $44,580 for a family of five

200% of the FPL: $29,160 for an individual, $59,160 for a family of three, and $89,160 for a family of five

400% of the FPL: $58,320 for an individual, $118,320 for a family of three, and $178,320 for a family of five

These changes may impact eligibility for various programs, including:

Medicaid and CHIP: Individuals and families with incomes up to 138% of the FPL may be eligible for these programs.

ACA marketplace plans: Individuals and families with incomes between 100% and 400% of the FPL may be eligible for premium tax credits.

Implications of the 2025 FPL Guidelines

The updated FPL guidelines have significant implications for individuals and families who rely on government programs for healthcare and financial assistance. Some key implications include:

Increased eligibility: The increased FPL guidelines may make more individuals and families eligible for programs like Medicaid and CHIP.

Changes in premium tax credits: The updated guidelines may affect the amount of premium tax credits available to individuals and families who purchase ACA marketplace plans.

Impact on healthcare costs: The FPL guidelines may influence healthcare costs, as individuals and families who are eligible for programs like Medicaid and CHIP may have lower out-of-pocket expenses.

The 2025 Federal Poverty Level guidelines are an essential update that can impact various aspects of our lives, from healthcare to financial assistance programs. Understanding these guidelines is crucial for individuals and families who rely on these programs. By staying informed about the changes and implications, you can make informed decisions about your healthcare and financial well-being. Visit

20somethingfinance.com for more information on personal finance, healthcare, and government programs.

Note: The information provided in this article is subject to change and may not reflect the most up-to-date information. It's essential to consult the official government websites or seek professional advice for the most accurate and personalized guidance.